More About Estate Planning Attorney

More About Estate Planning Attorney

Blog Article

Estate Planning Attorney Things To Know Before You Buy

Table of ContentsSome Known Questions About Estate Planning Attorney.Estate Planning Attorney for BeginnersEstate Planning Attorney for DummiesWhat Does Estate Planning Attorney Mean?

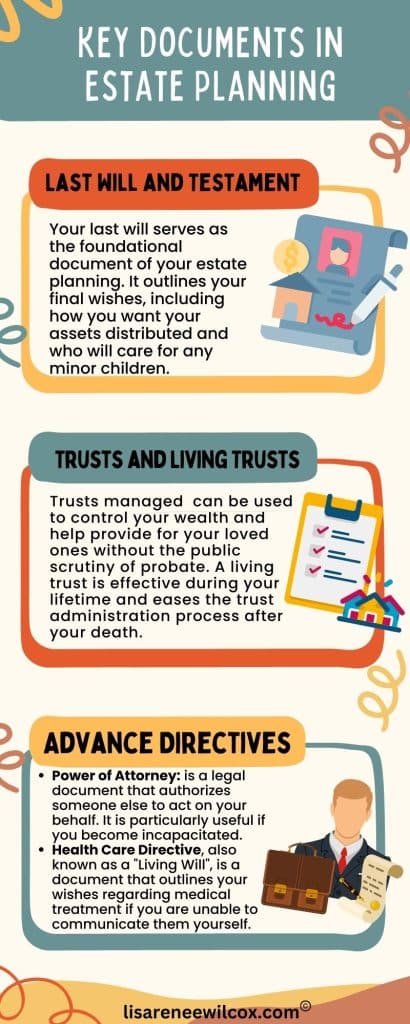

Estate preparation is an action strategy you can make use of to establish what happens to your properties and obligations while you live and after you die. A will, on the other hand, is a lawful paper that describes exactly how properties are distributed, that deals with children and pet dogs, and any kind of various other dreams after you pass away.

The administrator also has to settle any kind of tax obligations and debt owed by the deceased from the estate. Creditors typically have a restricted amount of time from the day they were notified of the testator's death to make insurance claims versus the estate for cash owed to them. Insurance claims that are denied by the executor can be brought to justice where a probate court will certainly have the last word as to whether the case stands.

Things about Estate Planning Attorney

After the stock of the estate has actually been taken, the value of possessions calculated, and tax obligations and financial debt settled, the executor will certainly after that seek permission from the court to distribute whatever is left of the estate to the beneficiaries. Any kind of inheritance tax that are pending will come due within 9 months of the date of fatality.

Each individual places their properties in the count on and names someone aside from their partner as the beneficiary. A-B trusts have actually become much less popular as the estate tax exception works well for the majority of estates. Grandparents may move properties to an entity, such as a 529 strategy, to support grandchildrens' education.

Estate Planning Attorney - Truths

Estate planners can collaborate with the donor in order to reduce gross income as a result of those payments or develop techniques that maximize the effect of those contributions. This is another strategy that can be used to limit death taxes. It includes an individual securing the current worth, and therefore tax liability, of their residential or commercial property, while connecting the value of future growth of that capital to an additional person. This approach includes freezing the see this page value of a possession at its value on the day of transfer. As necessary, the his comment is here amount of prospective funding gain at fatality is also iced up, permitting the estate organizer to approximate their possible tax obligation upon fatality and far better plan for the payment of income tax obligations.

If sufficient insurance earnings are available and the policies are effectively structured, any earnings tax on the deemed dispositions of possessions complying with the death of an individual can be paid without considering the sale of assets. Proceeds from life insurance policy that are received by the recipients upon the death of the guaranteed are generally revenue tax-free.

Various other fees connected with estate preparation consist of the preparation of a will, which can be as reduced as a couple of hundred bucks if you make use of among the finest online will certainly manufacturers. There are particular papers you'll require as component of the visit this website estate planning procedure - Estate Planning Attorney. A few of the most typical ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a myth that estate preparation is just for high-net-worth individuals. That's not true. Estate planning is a tool that everyone can make use of. Estate preparing makes it less complicated for people to identify their desires prior to and after they pass away. Unlike what the majority of individuals think, it expands beyond what to do with assets and liabilities.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

You need to start intending for your estate as soon as you have any kind of quantifiable asset base. It's a recurring process: as life progresses, your estate strategy ought to shift to match your circumstances, in line with your new goals. And keep at it. Refraining your estate preparation can trigger excessive monetary burdens to loved ones.

Estate preparation is usually taken a device for the affluent. But that isn't the case. It can be a beneficial means for you to take care of your possessions and responsibilities prior to and after you pass away. Estate planning is also a wonderful method for you to outline strategies for the treatment of your minor kids and pet dogs and to outline your dreams for your funeral service and favorite charities.

Applications should be. Qualified candidates that pass the test will certainly be officially accredited in August. If you're qualified to sit for the examination from a previous application, you might submit the short application. According to the policies, no accreditation will last for a period longer than 5 years. Discover when your recertification application is due.

Report this page